As this Federal Reserve monthly business survey demonstrates, and as we continue to see in our personal and business lives, economic conditions in the mid-Atlantic and here in Northern Virginia aren’t positive. Anecdotal feedback around the horn shows folks having a very hard time finding jobs (particularly college), businesses having a hard time finding skilled workers (with rising volume of layoffs and offshoring in the IT community), small business loans still difficult to get, credit balances going up along with interest rates, costs of materials and services still increasing, all kinds of Covid-style fees showing up on receipts (isn’t that over?) – all leading to continually rising consumer and B2B prices. This does increase demand for very smart, focused, cost-effective marketing – but there’s a limit even here. So-called “Bidenomics” paired with sharply-increasing threats across many vectors of our social and security fabric isn’t a good trend at all – we seem to be waiting for the “other shoe to drop”, so to speak.

This appears very interestingly in contrast to the recent, national CFO survey – which indicated overall slight optimism in most economic indices for businesses. I.e., fewer indicators of recession. Why is this? We see it as a small vs. large business outlook – i.e., smaller businesses are far more impacted by macro economic conditions than large, with more difficult recovery options and plans. We’ll see.

The March special questions – about “Return to Office” (RTO) practices, are dead-on; essentially businesses are poking and prodding at this genuine need, but resistance is strong, competition is strong, employment is hard. So we remain a bit stalled, with incremental movement and intentional RTO policies (though light). While we understand, as business owners, that more facetime among employees and between supervisors/subordinates is absolutely critical for healthy, productive team growth and innovation.

The point of this WestXDC initiative, however, is not to simply report and assess economic and business impact in our region – but to come together with actual, living support and solutions to raise the tide and lift all boats. Much more of that coming this year, particularly networking, with our relocation into Alexandria, VA!

Here are the top-line, summary results, from the March Survey – Federal Reserve Bank of Richmond:

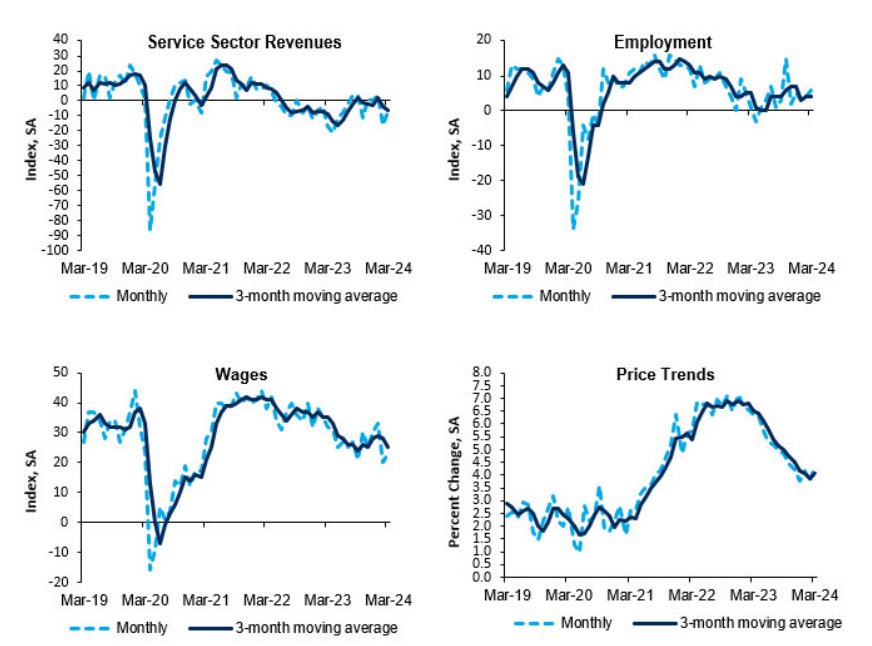

- Non-Manufacturing Activity Remained Soft in March – easy to see

- Our revenues index showed improvement but remained negative, as it registered at -7 in March (compared to -16 in February) – purchasing is happening, still

- Firms remained optimistic about future revenues as this index stayed positive at 14 – as we must

- Demand remained in contractionary territory at -8, but firms expect demand to pick-up in the next six months (17) -really “hope” to pick up

- All three spending indexes – CapEx, Equipment & Software, and Services – continued their declines in March – confirmed

- Firms don’t anticipate increasing spending in the next six months as all the forward-looking indexes all turned negative

- Our local business condition remained negative at -8, with firms slightly less negative about the future (-3)

Hiring

- Employment Increased Slightly in March – we see slight upticks every year in the Spring

- More firms increased employment than decreased, as our index registered at 6 in March – a point of light

- Looking ahead, firms expect to increase hiring, although, the forward-looking employment index has been decreasing over time (10 in March versus 15 in

February and 18 in January) – again, some motivated hope - Wages, as for the past three years, have been firmly in positive territory, and firms don’t expect wage increases to come down any time soon – it’s the least that can be done, in the face of crushing inflation and tough economics, along with dearth of skilled workers – the alternative seems simply to stop hiring, or fire

- The availability of workers with the right skills remained negative, which is interesting especially as we hear that labor market has been tight – noted

Prices

- Input Prices Declined While Prices Charged Nudged Up – the supply chain’s recovered a bit, but inflation negates that

(March Special Questions)

- Most Mon-Manufacturing Firms Have Implemented an RTO Policy Since 2021 – i.e. formalizing separation between work-from-home and in-office

- About 1-in-4 non-manufacturing firms have not implemented any RTO policy for their company – holding on, maybe a little scared to act

- Among those who did implement an RTO policy, more than 4-in-5 have been in the office before 2024 – maybe some FOMO in play

- Only 12 percent of companies have not begun enforcing their RTO policies – this is very “light” enforcement, i.e. firing really can’t happen

- About 3-in-4 non-manufacturers expect workers to be onsite at least 3 days per week – we see this more and more, including here, a good trend

- Sixteen percent of non-manufacturers have policies that allow workers to be in the office one day per week or less – this shall quickly pass, it must