As the year draws to a close in Northern Virginia, businesses in areas like Fairfax, Loudoun, and Prince William grapple with persistent challenges much attributed to the broader economic policies of the current administration – i.e. the so-called “Bidenomics” effect. Throughout 2023, supply chain disruptions have cast a shadow, hindering the seamless flow of goods and materials crucial for businesses across the region – seen directly among local builders and fabricators, for example. Many companies connect these disruptions to regulatory shifts and decisions impacting trade and production, prompting a reevaluation of their operational strategies.

We directly see the impact among many smaller businesses – from the tremendous increase in weekly rental car business around NOVA, to spike in “solopreneur” and second business-starters in Fairfax, to the crash among mortgage services and significant decrease in availability of small business credit. Optimism for improved business conditions is low, hard-to-generate and not supported in much near-term policy relief.

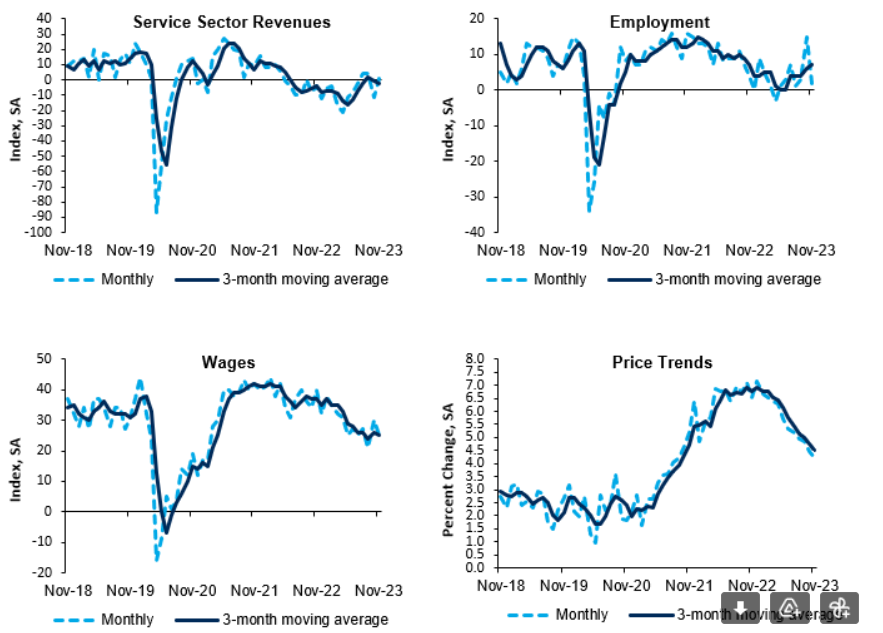

Here’s the view from the Federal Reserve’s Non-Manufacturing Activities Survey, November 2023, in our region (District 5):

Non-Manufacturing Activity Was Mixed in November

- After a sharp drop in revenues in October, our revenues index regained some ground in November as it registered at 1 (up from -11 in October) – generally a slight buying correction, but very weak

- Demand for goods and services is in an interesting position – an equal proportion of firms in November cited increased demand as decreased. However, forward-looking expectations about demand has dropped off a cliff (+25 in September, 2 in October, and -3 in November). – this is quite negative and concerning

- Firms’ attitudes about local business conditions were generally negative, as our index registered at -9 in November (slightly improved from -15 in October) – a persistent, unchanging theme

- Looking ahead, firms have become less pessimistic (but still pessimistic) about future conditions as our index improved to -7 in November from -22 in October – some end of year, optimistic correction

- Spending was mixed in November, as our CapEx index was in contractionary territory while the equipment & software spending category remained expansionary – seems to be more preparation for resilience, hard markets and in-house maintenance

In Arlington and Alexandria, a scarcity of available, skilled, productive workers persists across various industries. Local businesses in these areas closely link this labor shortage to perceived economic policies impacting employment trends. This shortage has impeded growth and operational capacities, intensifying challenges for these enterprises. Moreover, rising prices have raised concerns among businesses and their owners. They attribute these price hikes to broader economic policies, leading them to navigate the delicate balance between profitability and maintaining fair prices for their customers.

Looking forward to 2024, businesses in regions like Prince William and Alexandria are proactively adapting strategies to address ongoing challenges. For example, there’s a growing recognition across Northern Virginia of the need to invest more in online digital marketing, considering a brand refresh, and integrating online customer service automation. This shift reflects a response to the evolving market landscape and the now essential need for a robust online presence in a post-pandemic world.

The lessons learned in 2023 are fueling strategic planning efforts for Northern Virginia businesses, urging them to embrace digital transformation to reduce and avoid costs, stretch resources, anticipate shortages and slowdown, and altogether maintain market share and presence. Collaborative endeavors and innovative approaches are being prioritized as companies gear up to navigate the anticipated impacts of policy-driven economic shifts. With increased attention to online digital marketing, brand revitalization, and online customer service automation, businesses are positioning themselves to meet evolving consumer demands and seize opportunities in what’s forecast as a very difficult economic landscape of 2024.